Rakuten’s $900 million strategy is to transform Viber into Line. But it won’t be easy.

Today’s big news is Rakuten’s acquisition of Viber for nearly $900 million. Taking a step back to look at the strategy behind it, Rakuten is focusing on the growth of mobile messaging platforms and aiming to ape one of Asia’s fastest growing and most important tech firms: Japanese chat app Line.

Let’s first establish why Rakuten, a company that makes 400 billion yen (nearly $4 billion) in annual revenue from a range of online retail businesses, feels compelled to enter the free calls and chat space at the cost of nearly $1 billion.

Why messaging?

Chat apps have become important platforms in Asia, where more than just allowing free calls and text chats, they are stacked with features that rival social networks for the attention of smartphone owners. The platformization trend hasn’t made it into Europe or the US yet, but there is plenty of evidence to suggest that users are open to more than basic messaging apps.

Line, the app from Japan that has 350 million users across the world, embodies the potential.

It grossed $318 million in revenue for 2013, with 60 percent of its income coming from in-app purchases within the 30-plus apps on its gaming platform. Its total income in the final quarter of 2013 grew 450 percent year-on-year. As if scaling at speed is not enough, it is testing new revenue streams such as e-commerce, flash sales and breaking news.

Aside from games, stickers and other sales, it runs a marketing platform that lets users opt-in to receive information and updates from a range of global business — including McDonald’s — each of which pays for the privilege.

In short, messaging apps are just scratching the surface of what can be delivered on mobile. Any company involved in Internet content or services should be keeping an eye on the space, particularly if it is based in Asia.

Rakuten ticks all those boxes. In addition to buying up prominent retail sites like Buy.com and Play.com, it has focused on entertainment to push its brand into international markets. It bought into hardware (acquiring Kobo) and content (with deals for Viki and Wuaki) and now it is moving into distribution.

Why Viber?

Simply, Viber is the messaging app with the greatest scale that is most open to being bought.

- WeChat: 270 million active users and owned by Internet giant Tencent — no sale

- WhatsApp: only Facebook eclipses it for international social reach — no sale: too expensive / unwilling to sell to a company unfamiliar worldwide

- Line: busy (reportedly) planning an IPO; has a solid business model and plenty of ambition — no sale

- Kakao Talk: 150 million users, also linked with an IPO, and has global ambition — sale unlikely: price multiple billions

- Kik: 100 million users is not the scale of Viber, is focusing its efforts on enabling the mobile Web and Web apps — sale unlikely

- Viber: still in its early days of making money, claims 280 million registered users and has raised no external money (that’s a big potential pay day) — bingo

Viber may be the best fit, but there are questions.

It has never released a figure for its active user base. It claims to have users located in 193 countries but, as a European startup, you would expect a minority of them to be in the US (a market Rakuten aspires to succeed in) and Asia, its primary focus.

Now what?

Rakuten has some work to do to ape Line though. The Viber service focused on voice calls and has been kept simple, it doesn’t include the robust mechanics of its Asian rivals that include payments, e-commerce, games, marketing and more.

Viber makes money by selling stickers and Skype-like international calling credit, both of which are recently introductions.

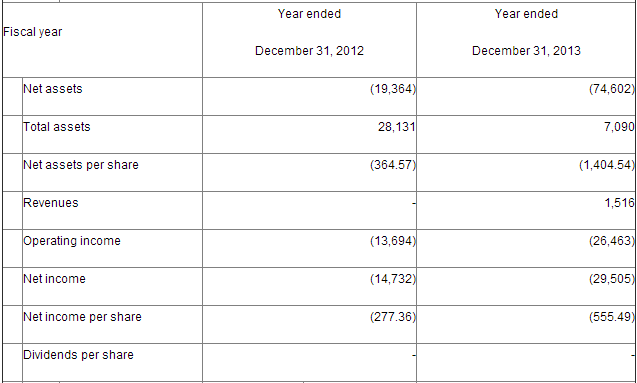

Information disclosed by Rakuten shows that Viber made just over $1.5 million in revenue last year, that’s small change compared to Line and WeChat, and even WhatsApp and its $1-per-user-per-year strategy. Overall, Viber recorded a $29.5 million net loss for 2013, and a $14.7 million net loss in 2012.

Yet, CEO Hiroshi Mikitani believes Viber has “tremendous potential as a gaming platform,” and he outlined his plan to use the service to deliver content:

Viber understands how people actually want to engage and have built the only service that truly delivers on all fronts. This makes Viber the ideal total consumer engagement platform for Rakuten as we seek to bring our deep understanding of the consumer to vast new audiences through our dynamic ecosystem of Internet Services.

This strategy is neither easy nor cheap to execute. Line’s parent company is spending heavily — with reports of $200 million annual investments — as it seeks to gain visibility among users worldwide, and to appeal to game developers and companies that it needs to attract to its platform.

Line began 2013 with 100 million registered users, and ended it with over 300 million. This year it is targeting 500 million and, while it still doesn’t reveal active user numbers, it is an important service because it changing how companies interact with consumers.

That’s why Rakuten is getting into the messaging game with Viber, albeit at a hefty price.